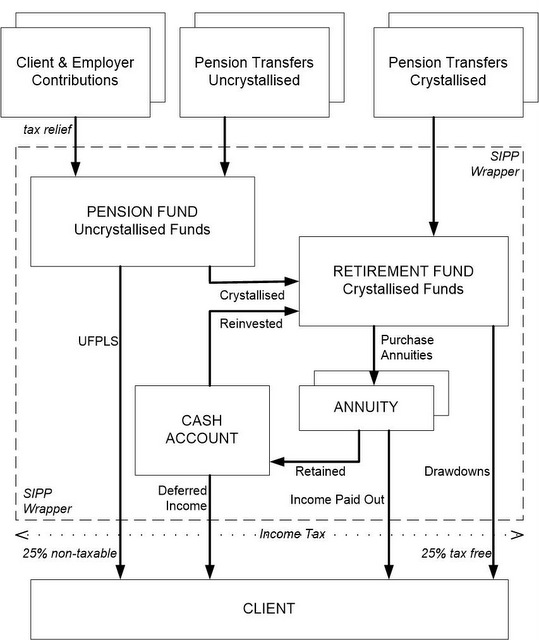

SuperFlexi Hybrid Drawdown Annuity

An end to end pension solution used to accumulate, consolidate and decumulate with seamless access to drawdown, guaranteed income or both. SuperFlexi is a SIPP wrapper comprising:

- Pension Fund

- Retirement Fund

- Annuities

- Cash Account

As these are within the same SIPP wrapper there are no tax implications for transactions within them.

Pension Fund

Consisting of uncrystallised funds accepting client & employer contributions and transfers from external uncrystallised pension funds. The client may access the Pension Fund directly using uncrystallised funds pension lump sums (UFPLS) with 25% of the pay out being non-taxable.

Retirement Fund

Consisting of funds crystallised from the Pension Fund and transfers from external crystallised pension funds. The Retirement Fund is able to remain invested for further growth and can be used to fund the purchase of Annuities and for drawdown of cash to the client until the fund is exhausted.

Annuities & Cash Account

Annuities provide a guaranteed income for life. However, some years that income may not be needed and, indeed, not wanted if it then would push the client into a higher income tax band. With SuperFlexi that income can be redirected to the Cash Account for a deferred income in later years or for reinvestment in the Retirement Fund. This transforms a rigid income for life into a flexible income for life.